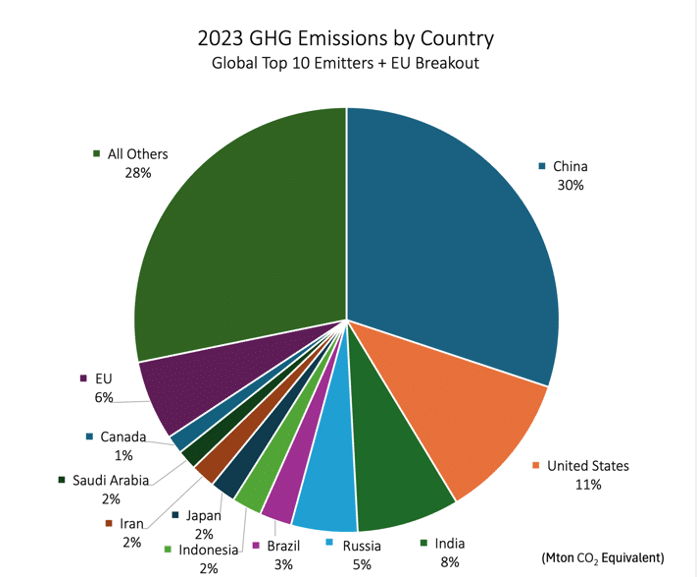

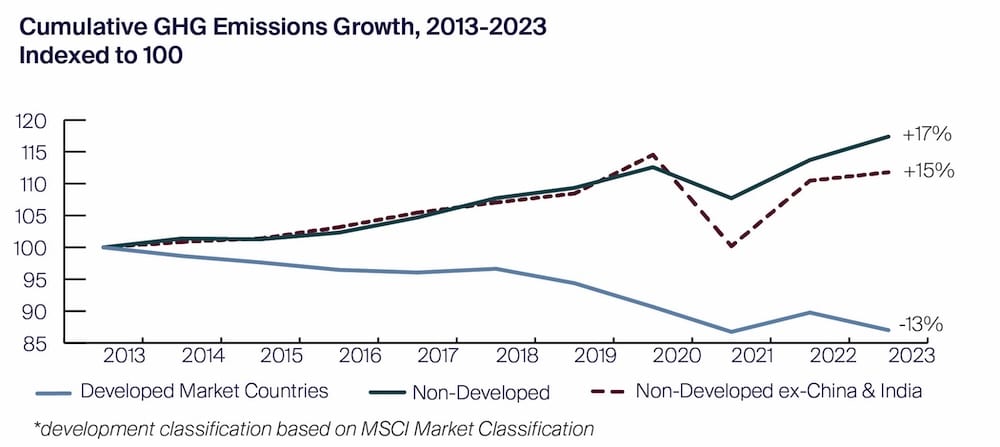

Importantly, the trajectories of emissions differ markedly across these countries. From 2013 to 2023, total greenhouse gas (GHG) emissions from the United States fell 7%, while China’s emissions rose 21%, Russia’s emissions rose 19%, and India’s emissions soared 34%. Of the 4,282 metric tons of CO2-equivalent net increase in global emissions since 2013, China accounted for 65%, and India for 24%. These figures highlight a focus on these two emerging powerhouses to ensure collective goals are met.

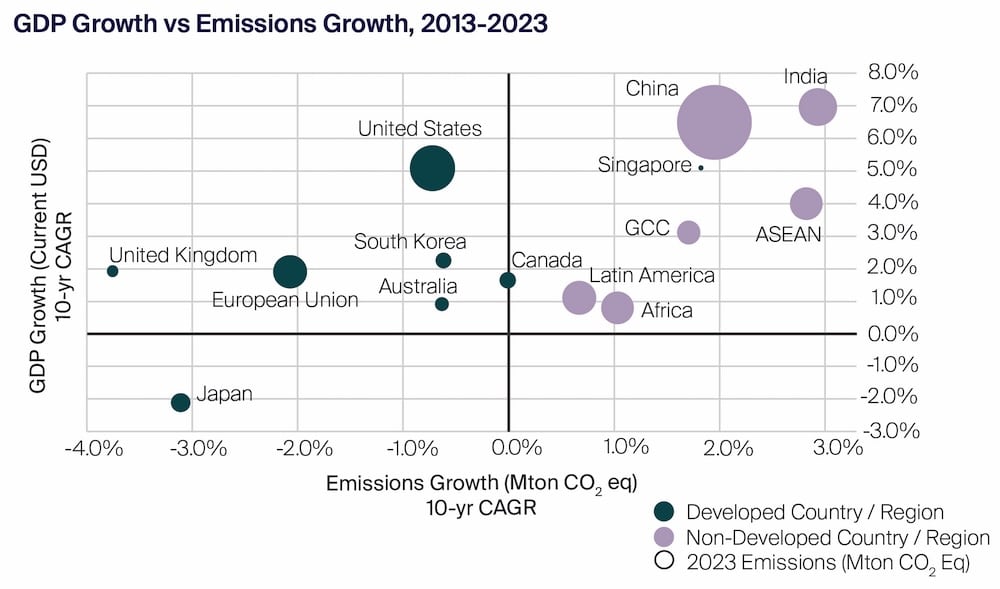

Much of China’s and India’s emissions growth stems from their substantial economic development over the past few decades. The combination of ballooning populations and favorable demographics, along with accelerated modernization, drove their economies to be among the fastest growing in the world, with China’s nominal gross domestic product (GDP) growing at a 6.5% compound annual growth rate and India’s GDP growing at an even quicker 7.0% clip since 2013. These figures well outpace each country’s emissions growth rate, a decoupling from a historic trend in which GDP growth tends to move in lockstep with emissions growth. Without measures to reduce emissions during the process, global emissions would likely increase much more rapidly, underscoring the need to decouple GDP growth from emissions growth.

Although it is clear that China and India have had a disproportionate negative impact on global emissions growth in recent years, both countries have excelled in the early adoption of green technologies. China’s solar and wind capacity currently exceeds the country’s 2030 target for 1.2 terawatts of renewable energy capacity, accounting for almost 60% of new renewable capacity added worldwide. India is also succeeding in adopting renewable energy, with initiatives including expanding electrification and grid improvements, increasing investment in solar capacity, and mandating ethanol fuel blending with biofuel development targets. Lessons from China’s and India’s transitions can be gleaned and applied to neighboring Southeast Asian countries, a region projected to have among the highest emissions growth in the world going forward.

Emerging markets and developing economies (EMDEs) remain as the top contributors to global emissions growth, accounting for 95% of the total increase in global GHG emissions over the past decade. Even excluding India and China, EMDEs will continue to drive global emissions growth. EMDEs face a unique challenge in aligning economic growth and development with climate change mitigation. Many of these countries have fast-growing populations, expanding workforces, accelerating GDP growth, and rising energy demand, yet their weaker infrastructure cannot keep pace.While China’s and India’s emissions are expected to taper and eventually peak, most EMDEs will see accelerating emissions growth in the near term. Additionally, EMDEs are particularly vulnerable to climate-related risks and wealth destruction. As such, EMDEs require keen attention going forward. In the matrix below, a clear trend is apparent: a “developed” status is typically associated with the ability to reduce forward emissions without significant harm to the country’s GDP growth.

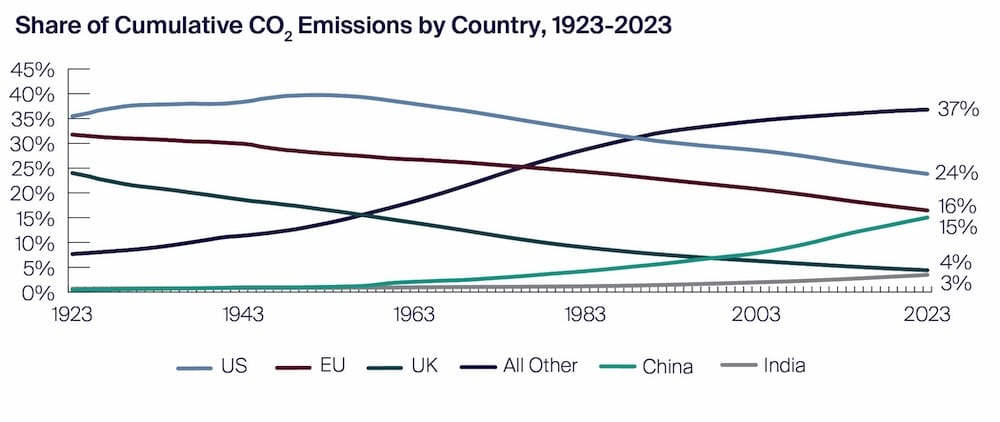

The United States, Western Europe, and other developed nations advanced and industrialized without environmental regulation, driving massive economic growth across these countries. Developed nations are the largest cumulative emitters, and their historic emissions have significantly improved their development trajectories. This dynamic fundamentally shaped the global economic order today, transferring great power to these nations at the expense of EMDEs and the environment. Following efforts toward stricter climate regulation, the rapid adoption of climate-positive technologies, urbanization, and a transition toward service-based economies, the burden of future emissions growth has now entirely shifted from developed to developing countries.

Over the past decade, developed countries have retained the ability to divert capital resources into climate change mitigation efforts without significant economic detriment. At the same time, annual climate investment in EMDEs will need to increase to an estimated $2.4 trillion by 2030 to meet Paris Agreement goals, of which nearly $1 trillion per year will need to come from external sources. One critical question emerges: How can developed countries support the development and progress of EMDEs without causing significant increases in emissions and resource degradation?

Regardless of the country or region, a key underlying message is clear: the transfer of resources from developed to developing nations through investment is a top priority that will help balance the global economic structure and ultimately lead to a successful climate transition. This approach allows developing countries to borrow at lower costs while also reducing the risk for investors and capital providers.As investors, it is crucial that we do not shy away from countries that are currently missing climate targets or are behind on the development curve. Instead, targeted cross-border investment in productive projects will drive a shift from decarbonizing portfolios to decarbonizing the planet—a win-win for society. This thesis underpins Saturna’s approach to global sustainable investment, providing healthy, diversified returns without assuming outsized risk.

Article by Pierce McCrerey, Fixed Income Analyst, who joined Saturna Capital in June 2021. He graduated from Montana State University in Bozeman with a BS in Business Finance and a minor in Entrepreneurship. Prior to Saturna, he worked in custom home construction and renovation. Pierce is a Chartered Financial Analyst (CFA) charterholder. Outside of the office, Pierce enjoys skiing, mountain biking, and traveling around the world.

About Saturna Capital Corporation

Saturna Capital Corporation, established in 1989 in Bellingham, Washington, USA, is an independent, employee-owned investment advisor that manages approximately $10 billion in client assets and provides investment advisory services to mutual funds, institutions, businesses, individuals, and endowments. Saturna Capital is an adviser to the Amana Mutual Funds Trust, the oldest and largest family of funds in the US that adheres to Islamic finance principles. Saturna Capital is also an adviser to the US-based Saturna Funds.