Two Canadian advocacy groups have written an open letter to Canada’s chief actuary, Assia Billig, to raise concerns that her office is significantly underestimating the systemic risks of climate change.

The Office of the Chief Actuary (OCA) is failing to consider worst-case scenarios or the true extent of the potential impacts of global warming on the sustainability of Canada’s public finances, say Tanya Jemec and Karine Péloffy of Ecojustice, Canada’s largest environmental law charity, writing on behalf of the pension watchdog Shift: Action for Pension Wealth and Planet Health (Shift).

“While it is a fundamental duty of all actuaries to act in the public interest, the OCA’s obligation is particularly acute as its reports are used to inform policy direction and highlight risks for government and other decision-makers on matters that affect millions of people,” they write. For Canada’s public pension plans, “mismanaged climate change risks could harm the financial security of beneficiaries, reduce benefits and increase costs or require government bodies to cover shortfalls.”

The OCA has already published reporting that forecasts how climate change could affect Canada’s GDP under three transition scenarios. But what the OCA fails to include in its reports and assessments, Shift and Ecojustice claim, is the systemic risks of climate change, such as crossing critical thresholds that would lead to irreversible changes to Earth systems.

“The collapse of ice sheets, the halting of major ocean currents and permafrost melt are all examples of tipping points that are increasingly likely to be triggered if the global average temperature rises more than 1.5°C above pre-industrial levels,” they write.

In 2023, the Institute and Faculty of Actuaries (IFOA) in the UK published a report stating that tipping points must be included if scenarios are to be realistic. Such events are now considered “high impact, high likelihood, and we need to mitigate and plan for them. Ignoring them in scenarios and modelling significantly understates risk,” the authors write.

The chief actuary needs to do its job by ensuring its statutory actuarial valuations of federal plans and programs actually reflect the reality of these risks, so that they can be managed before it’s too late.

– Adam Scott, executive director, Shift Action

The OCA is also underestimating the consequences of climate change for GDP, according to the standard of the “the most recent, authoritative climate science and risk modelling,” say Ecojustice and Shift. While the OCA estimates no impact on baseline GDP by 2030 under a failed transition scenario and only an 8% decrease by 2050 and a 30% decrease by 2100, by contrast, the IFOA predicts a negative GDP impact of 65% to 73% by 2100 under the same scenario.

“Climate change is undoubtedly an existential threat of the highest order, a fact the OCA should recognize,” the authors of the letter argue.

Responding to a request for comment, media relations for Billig’s office said they were still considering the contents of the letter from Ecojustice and Shift. This article will be updated when further response is provided.

Risk exposure for Canadian pensioners

As fossil fuels are the primary cause of climate change, and the Canada Pension Plan Investment Board (CPPIB) holds significant investments in the sector, Canada’s public finances are exacerbating the problem – and the risks to beneficiaries.

“By directly contributing to the accumulation of greenhouse gases in the atmosphere, CPPIB’s fossil fuel investments facilitate rising physical risks across the portfolio,” Ecojustice and Shift argue. These investments are vulnerable to such transition risks as asset stranding, devaluation and sudden re-pricing as a result of policy changes, technological advances or market changes.

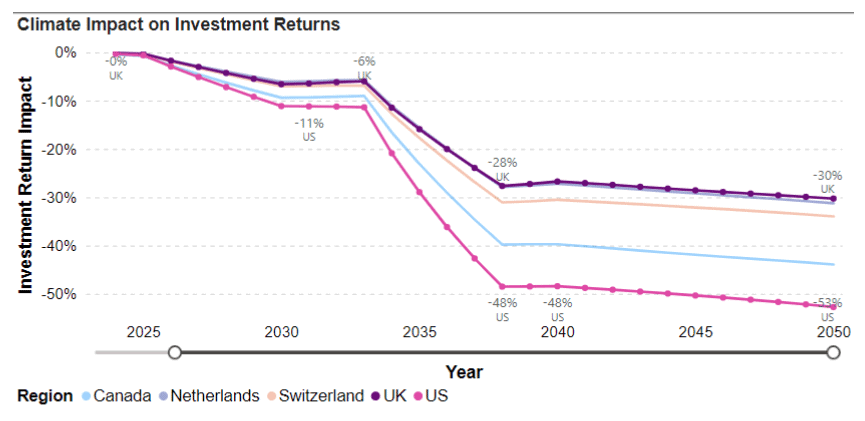

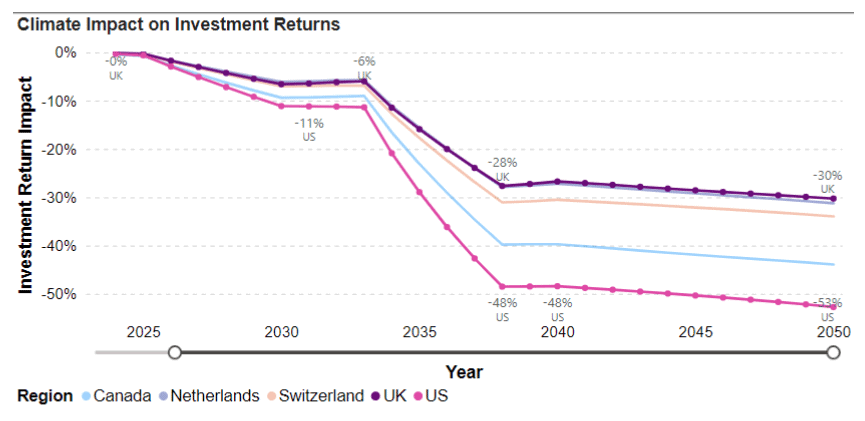

In a white paper published last September, the risk management firm Ortec Finance analyzed the climate risk exposure of five large pension systems worldwide, including the United States and Canada. The report found that North American pension funds could see their investment returns decline by 50% or worse by 2040 under a business-as-usual scenario where global warming reaches 3.7°C.

Left unaddressed, climate change will impact the U.S. pension system the most out of the five included in the report, but Canada also faces severe consequences. “A large majority of Canadian pension funds are highly exposed to physical risks,” according to Ortec. “The country’s exposure to severe climate events such as wildfires and droughts exacerbates these risks.”

The factors harming asset performance include rising temperatures, extreme weather and declining agricultural productivity.

“Many of Canada’s largest pensions are sleepwalking into a climate crisis with existential consequences for their members,” Adam Scott, executive director of Shift, said in a statement. “The chief actuary needs to do its job by ensuring its statutory actuarial valuations of federal plans and programs actually reflect the reality of these risks, so that they can be managed before it’s too late.”

RELATED

Most Canadian pension funds recognize the urgency of climate change. Some don’t.

Hydrogen won’t rescue pension funds from bad bets on gas

Death of ESG is greatly exaggerated, say pension managers

Shift and Ecojustice have made five recommendations to the chief actuary’s office: 1) include realistic climate tipping points and cascading impacts in risk assessments; 2) reassess economic models to avoid underestimating worst-case climate scenarios; 3) provide clearer qualitative descriptions of climate uncertainties and risks; 4) give greater consideration to risks from fossil fuel investments; and 5) integrate climate impacts into baseline financial projections.

“As a multifaceted crisis with severe impacts on the planet and its inhabitants, climate change impacts pension plan liabilities and assets, as well as beneficiaries and contributors,” the letter concludes. “The risks cannot be ignored until 2030 or 2050: They must be addressed now.”

Mark Mann is the associate editor at Corporate Knights. He is based in Montreal.

The Weekly Roundup

Get all our stories in one place, every Wednesday at noon EST.